Fast, easy and safe international money transfers

As provided by Dash Remit

Get competitive exchange rates and fast transfers with no variable fees when you use Dash Remit for international fund transfers.

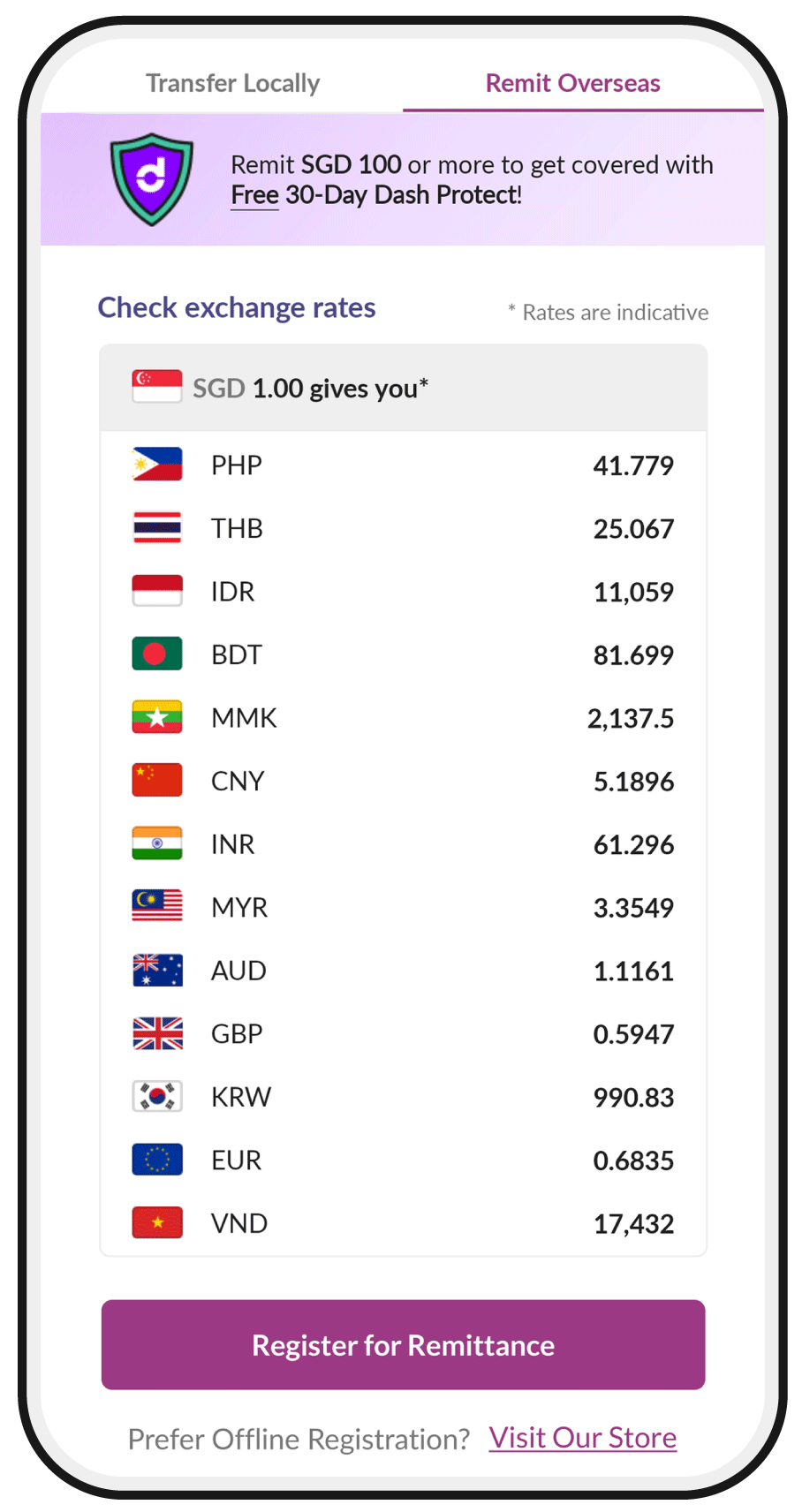

Competitive exchange rates

Check our rates and fees easily on our app. What you see is what you get!

Fast and easy

Real-time approval when you register for remittance with Singpass* and receive your funds transfer in less than a day^.

Safe and worry-free

The service is provided by SingCash Pte Ltd, licensed by Monetary Authority of Singapore and a subsidiary of Singtel.

Multiple support touchpoints

Need help? Reach us on WhatsApp, our hotline, email or at our Lucky Plaza retail shop.

*Manual registration will take up to 2 working days for approval if all information are

submitted accurately. Kindly contact our support team if you encounter any issues.

^Applicable for bank transfers to United Kingdom, South Korea and banks on instant transfer scheme in Europe, as well as to New Payment Platform enabled accounts to Australia.

Remit in 4 easy steps

Step 1

Select ‘Remit’ on your Dash app homepage > Tap ‘Register for Remittance’

Step 2

Add recipient by keying in your beneficiary’s details once your account is approved

Step 3

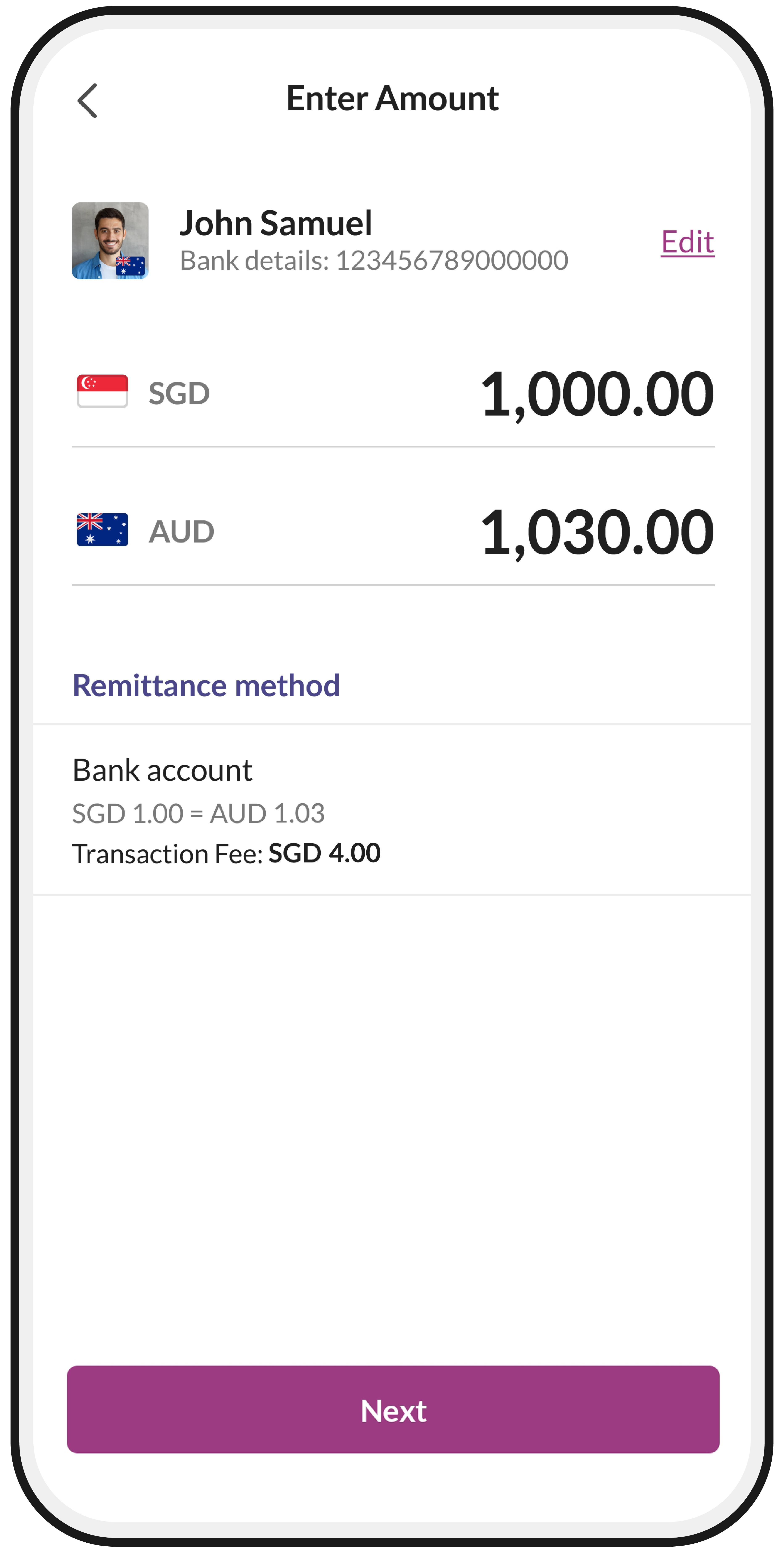

Select your recipient and indicate the amount you wish to transfer

Step 4

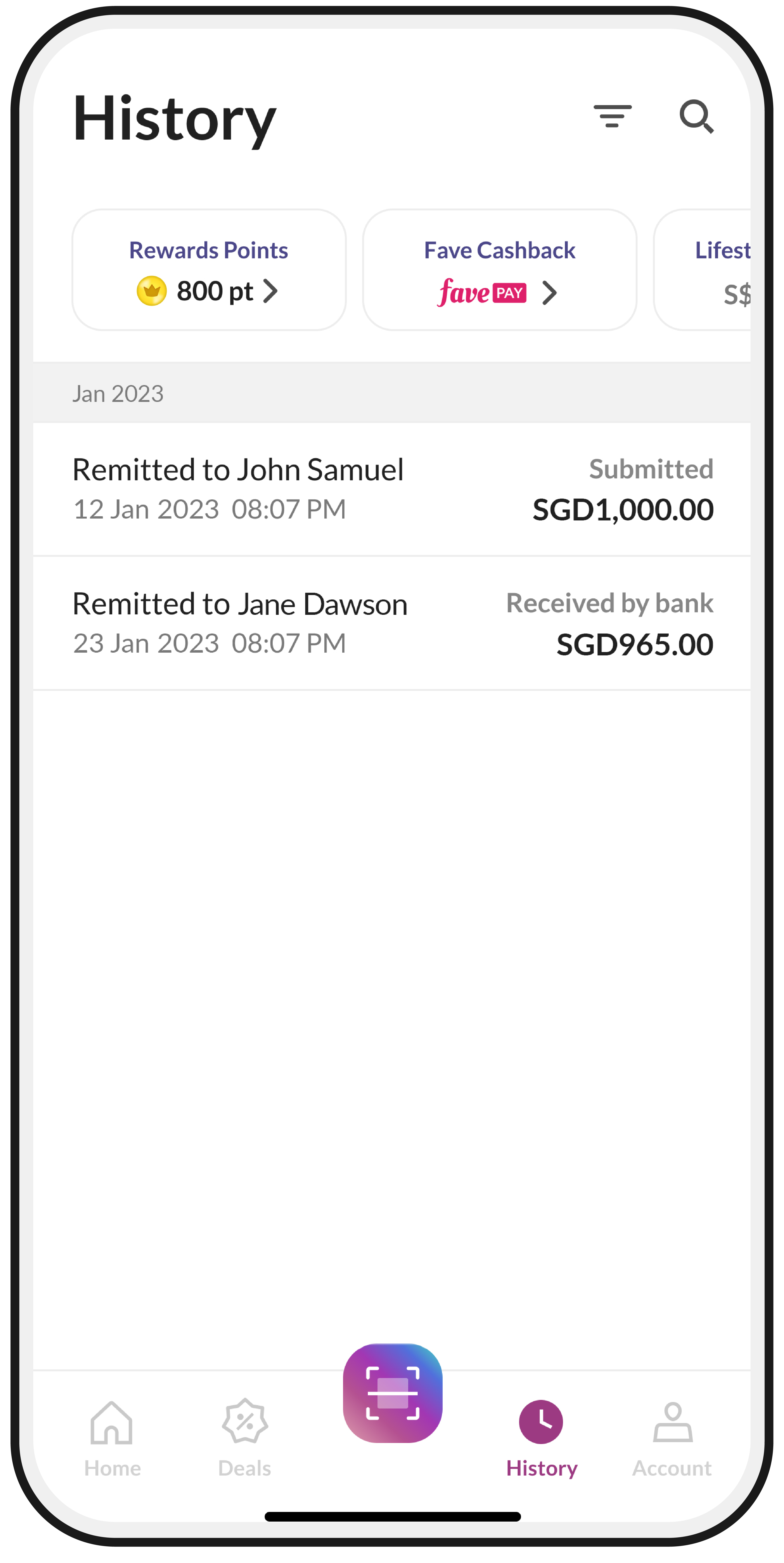

Tap on ‘History’ to check your transfer status

Send to these countries with Dash Remit today

Australia (AUD - Australian Dollar)

Austria (EUR - Euro)

Belgium (EUR - Euro)

Bulgaria (EUR - Euro)

Czech Republic (EUR - Euro)

Denmark (EUR - Euro)

Estonia (EUR - Euro)

Finland (EUR - Euro)

France (EUR - Euro)

Germany (EUR - Euro)

Greece (EUR - Euro)

Hungary (EUR - Euro)

Ireland (EUR - Euro)

Italy (EUR - Euro)

Latvia (EUR - Euro)

Lithuania (EUR - Euro)

Luxembourg (EUR - Euro)

Norway (EUR - Euro)

Poland (EUR - Euro)

Portugal (EUR - Euro)

Romania (EUR - Euro)

Slovakia (EUR - Euro)

Slovenia (EUR - Euro)

Spain (EUR - Euro)

South Korea (KRW – South Korean Won)

Sweden (EUR - Euro)

Switzerland (EUR - Euro)

United Kingdom (GBP – Pound Sterling)

Do more with Dash,

the all-in-one mobile wallet

Your trusty travel companion

Planning a quick getaway and need travel insurance? Purchase right from the Dash app and continue to tap and pay via Visa Contactless while overseas.

More mobile data

Get additional 1GB data when you pay for your Singtel postpaid mobile bill with Dash!

Stay connected all day

Using a Singtel prepaid mobile line instead? Top it up easily right from the Dash app.

Frequently Asked Questions (FAQ)

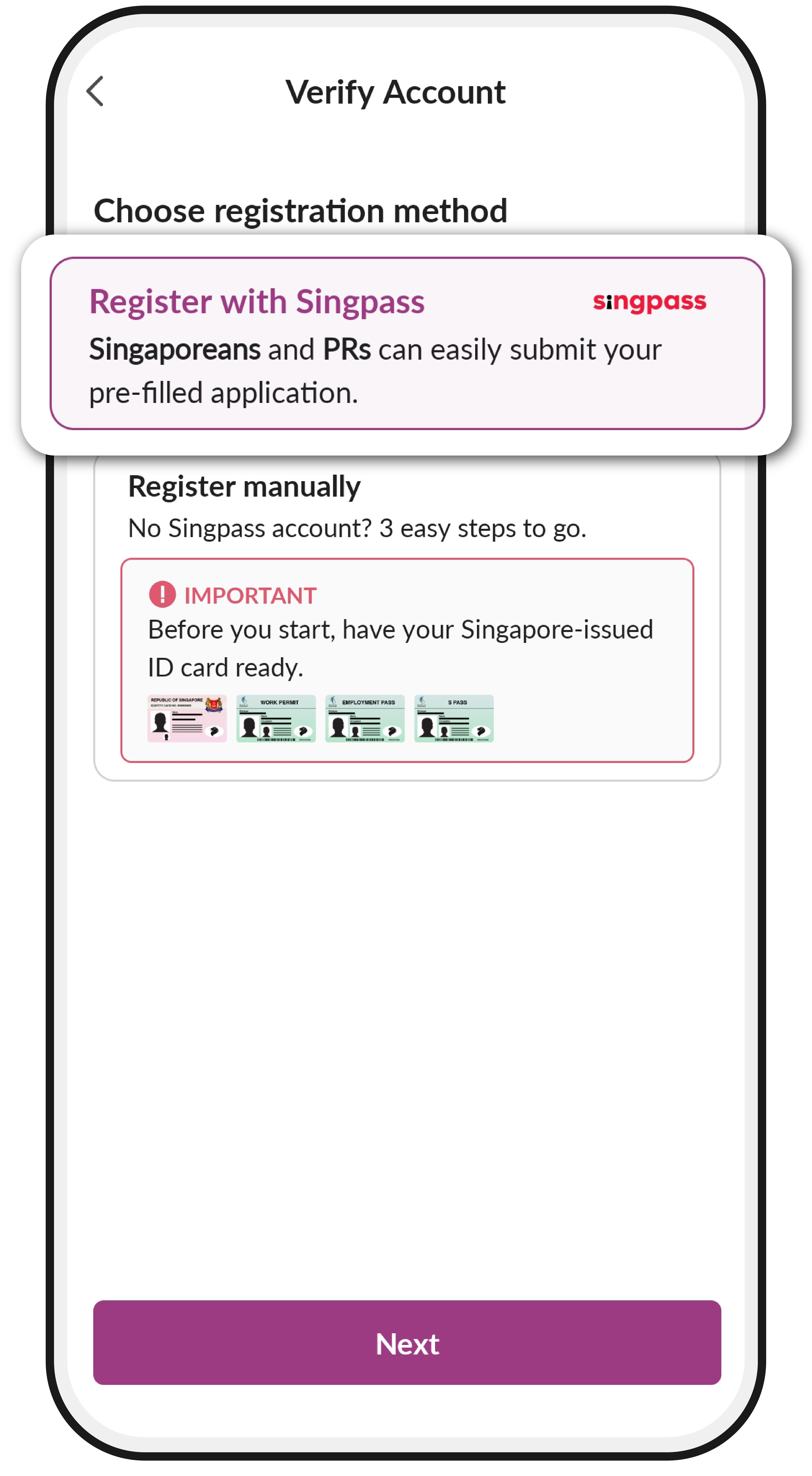

How do I start remitting with Dash?

To start remitting on Dash, you will have to register for a remittance account by verifying your

account using Singpass or keying in the required details manually. Simply tap on ‘Account’ > Your

name > ‘Update details’ OR ‘Remit’ > ‘Register for remittance’.

For manual verification, remember to have your work pass and proof of verification on hand.

Are there limits to how much I can send?

Upon verifying your Singtel Dash Mobile Remittance account, you may remit up to SGD5,000 a day and

SGD10,000 a month if you are not a Work Permit-holder with app versions 6.2.0 and above. If you are

a Work Permit-holder, you may remit up to SGD3,000 per day and per month.

The total Dash wallet debit transactions, including remittance, cannot exceed S$30,000 in a year.

What are the fees for overseas money transfer?

Singtel Dash Remit charges a low fixed fee that differs by destination.

For remittance to Australia, supported European countries (including United Kingdom) and South

Korea, a fee of SGD4 per transaction is applicable. Visit dash.com.sg/remit#TAT for fees to other

destinations.

What is the applicable exchange rate when I remit with Singtel Dash?

Our exchange rates are competitive so that you can get the best benefits. However, exchange rates

are subject to market fluctuations.

Log in to your Dash app, select ‘Remit’ to check the latest rates.

How long does a remittance transfer take?

Transfers to South Korea and the United Kingdom are real-time and will arrive within 15 minutes to 2

hours.

Transfers to other supported European countries will arrive within 15 minutes if the receiving bank

is on an instant transfer scheme. Otherwise, the money transfer will arrive on the next 1 or 2

banking day of the receiving country, excluding bank holidays and weekends.

For transfers to Australia, processing of the transaction will take place immediately, and you will

receive the final status of the transaction within 1 – 3 hours. Actual crediting of the remittance

funds by your chosen bank into your recipient’s bank account will take up to 7 – 14 hours.

What banks can I transfer to?

For the United Kingdom (UK), you can transfer money to all banks in the UK that are on Faster

Payments network.

For Australia, you can transfer to all available banks in Australia. For example, CBA, Westpac, ANZ,

NAB and Macquarie Bank

For other supported European countries, you can transfer money to all available banks in the

receiving countries.

For South Korea, you can transfer to a total of 18 banks. Including Hana Bank, Shinhan Bank, and Woori Bank.

For the full list, visit dash.com.sg/remit#TAT or refer to the Dash app.

What information is required to set up my recipient in Dash?

For transfers to Australia, you will require the following information from your recipient:

- First and last name

- Mobile number

- Bank account number

- BSB code

- Date of birth

- Nationality

- Address (in Australia)

- Postal Code (in Australia)

For transfers to the United Kingdom (UK), you will require the following information from your recipient:

- Full name (as in their ID)

- Mobile number

- Either (a) Bank account number and sort code or (b) IBAN number

- Date of birth

- Nationality

- Address (in the UK)

For transfers to other supported European countries, please obtain the following information from your recipient:

- First and last name

- Mobile number

- Nationality

- IBAN number

- Date of birth

- Address (in Europe)

As for South Korea, you will need these information from your recipient:

- First and last name

- Bank name

- Bank account number

- Mobile number

- Date of birth

- Nationality

- Address

Is there a reward point system? How many reward points do I earn per remit?

You can earn 50 Dash reward points for every remittance and redeem them for attractive vouchers.

Learn more about Dash reward points here.

How do I check the transaction status of my remittance transfers?

Tap on ‘History’ to check the transaction status of your remittance transfers.

What documents can be used as proof of address?

- Singtel, M1, Starhub bill or any other telco bill

- Bank statement

- Water or Electricity bill

How can I top up my Dash balance?

For your convenience, we provide you with multiple options to top up your Dash balance.

If you choose to top up your Dash balance using your mobile phone, you can do so from the Singtel

Dash app, eNETS account, PayNow VPA / FAST/ PayNow QR, PayAnyone OCBC, Dash PET, or credit/debit*

cards.

Top up facility is also available at 7-Eleven* outlets, AXS machines, Sheng Siong $TM*, Singtel Shops, Singtel Exclusive Retailers and Singtel Prepaid Retailers.

* Convenience fees applicable