How to Create your UOBAM Robo-Invest Portfolio

How to Create your UOBAM Robo-Invest Portfolio

By now you would have heard about the importance of planning your finances to achieve your retirement, lifestyle, and financial goals. But like many working adults, you may not have the time or expertise to pore over hundreds of options. UOBAM Robo-Invest offers a simple and effective alternative – use the Singtel Dash app to customise and build a portfolio which you can track at any time:

- Robo-advisory service managed by experts from award-winning1 asset manager, UOB Asset Management (UOBAM)

- Combination of machine algorithms and human expertise that aims to offer you reliable financial advice and portfolio recommendations

- Opt for a sustainable future with Environmental, Social and Governance (ESG) integrated portfolio

- Easy to start - from just S$1, enjoy low advisory fees from 0.6% p.a.**

1Please visit www.uobam.com.sg for details on the full list of our awards.

Start reaching your financial goals with UOBAM Robo-Invest

What sets UOBAM Robo-Invest apart is that it combines the insights and experience of UOB Asset Management’s

experts, with advanced digital algorithms. UOBAM Robo-Invest uses a proprietary smart algorithm to build a portfolio tailored to your needs.

Figure 1. UOBAM Robo-Invest’s key investment inputs by UOBAM’s investment and product committees

UOBAM Robo-Invest is the first robo-adviser to be exclusively available on a mobile wallet - Singtel Dash.

Singtel Dash app is available on the Google Play Store or Apple

App Store.

UOBAM Robo-Invest helps you access a portfolio customised to your risk level and financial goals. You can create

your UOBAM Robo-Invest portfolio in minutes. Once your account has been approved, you can start by funding your

account.

How do you create your portfolio?

Creating your UOBAM Robo-Invest Portfolio is simple. You can customize your portfolio in minutes, just by using

your smartphone - there’s no need for phone calls or emails.

Simply start by taking the risk assessment. The proprietary algorithm will then present

portfolio options, appropriate to your risk level and financial goals.

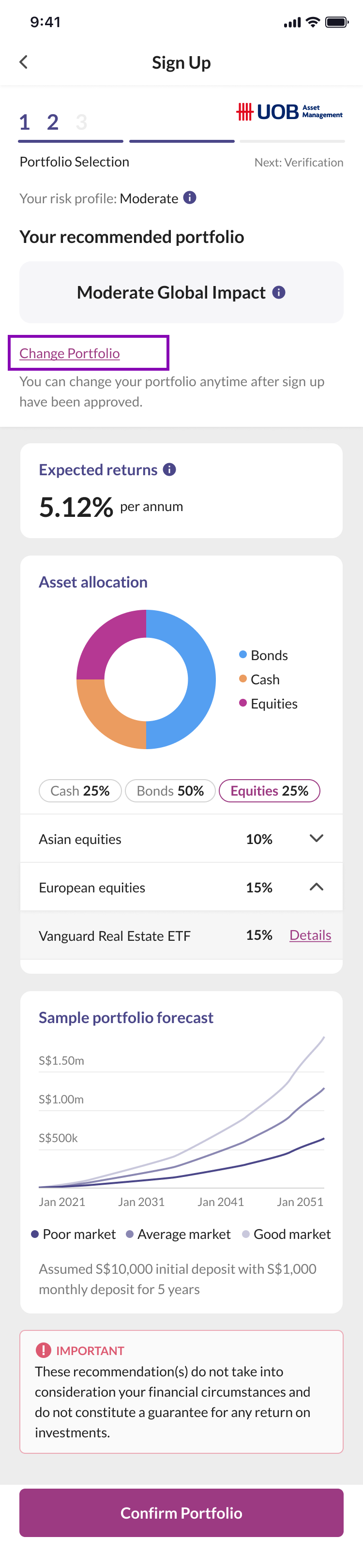

You can choose between Global (non-ESG) or Global Impact (ESG) portfolios.

The Global Portfolio holds a diversified range of assets that minimises drawdowns during market instability and

aims for a favorable risk/reward ratio. This portfolio comprises Exchange Traded Funds (ETFs) and SGD hedged unit

trust funds that aims to reduce risk of currency losses on foreign investments.

The Global Impact Portfolio is a globally diversified, multi-asset portfolio. This consists of ETFs and actively

managed funds that select assets with a strong emphasis on Environmental, Social and Governance (ESG) goals. The

Global Impact Portfolio lets you invest in companies with strong sustainability performance with Environmental,

Social, and Governance (ESG) standards incorporated into their operations. This balances the needs for wealth

growth, with a positive impact on the environment and our society.

Both the Global Portfolio and the Global Impact Portfolio are optimised to aim for returns, within the parameters

of your risk tolerance.

Read more about your portfolio

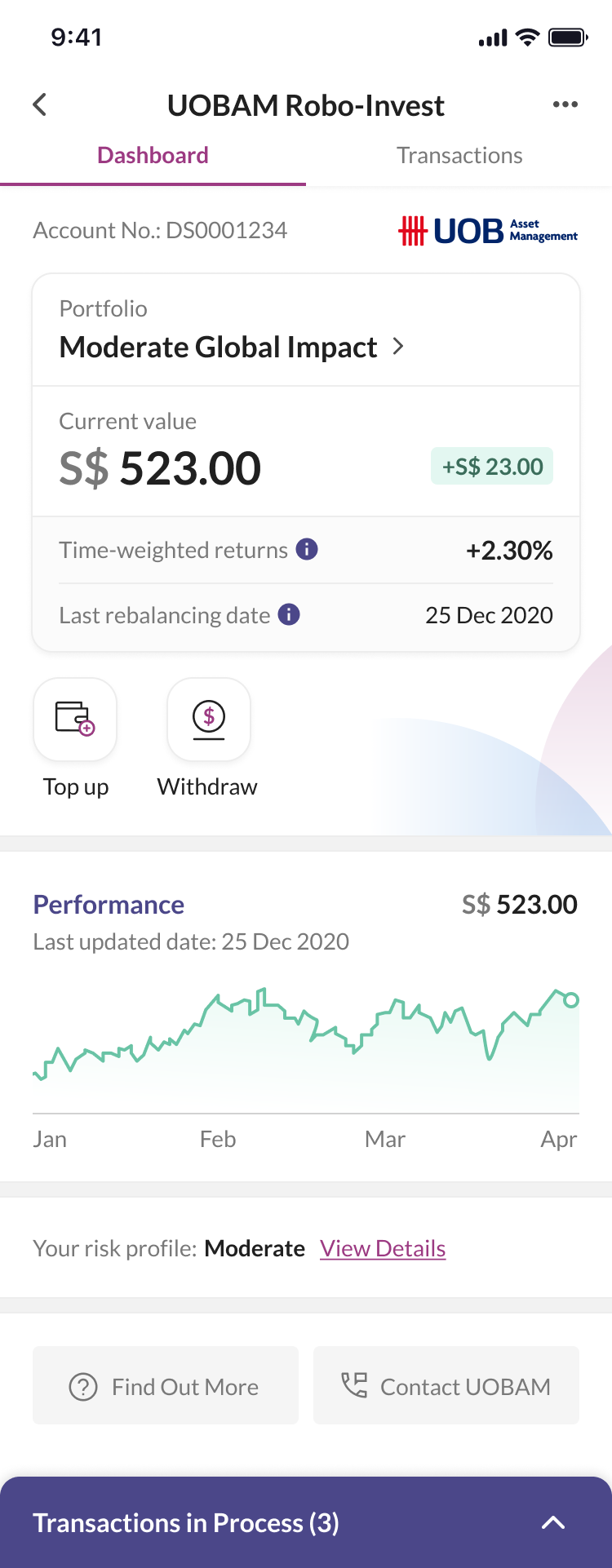

UOBAM Robo-Invest’s portfolio dashboard will present the expected returns, portfolio allocation, and sample

growth2 for your recommended portfolio (see Figure 2). UOBAM Robo-Invest’s scenario analytical tools

will keep you

informed on the portfolio performance probabilities during financial upturns, downturns, and regular market

conditions (see Figure 3).

2Unrealised gains (green), losses (red), or flat results (grey) will be reflected in your current

portfolio.

Figure 2. Full Portfolio Dashboard | Figure 3. Performance forecast across different market conditions

All references to any asset class are for illustration or information only and should not be relied upon or

construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or

likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of

the principal amount invested.

You can tap on ‘View Details’ to view any of the funds’ factsheets or prospectus.

Commit an amount you’re comfortable with

UOBAM Robo-Invest lets you start investing from as low as one Singapore Dollar, using PayNow (just use the Scan

and Pay feature).

(You can also use eNETS, which has a minimum of SGD$50).

There’s no limit to the number of top-ups or withdrawals you can make. Check out this article on how to start funding your UOBAM Robo-Invest account!

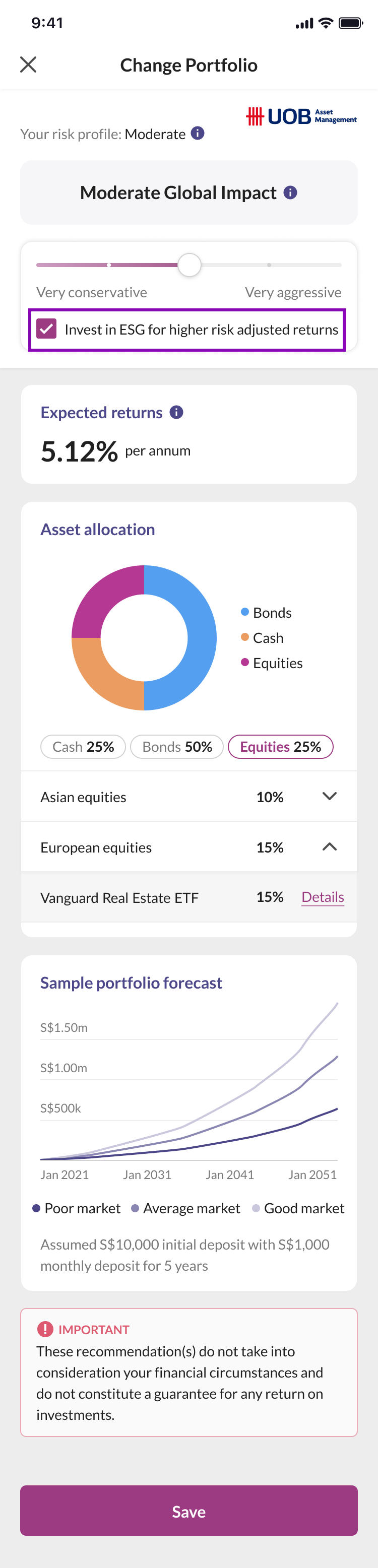

Changing your UOBAM Robo-Invest Portfolio

You can change your UOBAM Robo-Invest portfolio with just your smartphone.

Figure 4 and 5 (from left to right). Steps to changing your current portfolio and confirming your new selection

All references to any asset class are for illustration or information only and should not be relied upon or

construed as a recommendation of specific model portfolios. Projections shown are not indicative of future or

likely performance of any portfolio. Investments in any portfolio involve risks, including the possible loss of

the principal amount invested.

1. Tap on your portfolio name - This will reveal your current portfolio details

2. Tap on ‘Change Portfolio’ - (see Figure 4)

Use the slider to select your preferred portfolio.

3. Tick ‘Invest in ESG for higher risk adjusted returns’ - This is if you want to select the Global Impact

portfolio (see Figure 5)

UOBAM Robo-Invest will show you the expected returns, asset allocation, and sample portfolio forecast.

4. If you’re satisfied with the changes, tap ‘Change Portfolio’, and then ‘Confirm’.

The new portfolio will take effect at 10:30am on the next business day, once you perform a transaction. Do this by

tapping “top-up” or “withdraw” as appropriate (Figure 2), or you may choose to wait for the next rebalancing date.

UOBAM Robo-Invest will automatically rebalance your portfolio, when you top-up or withdraw funds. Discover how

this helps you here.

How are time-weighted returns different from money-weighted returns?

Time-Weighted Returns (TWR) show how your returns compound over time. You can view returns for specific time

periods, from the point when top-ups or withdrawals were made to your portfolio. TWR presents a more accurate

reflection of returns - it eliminates distortions in the growth rate, which may be caused by top-ups and

withdrawals (these distortions are not accounted for if you simply deduct the starting and ending balances).

Meanwhile Money-Weighted Returns (MWR) shows your returns by taking into account the timing and size of the

top-ups or withdrawals, as well as the performance of the investments in the portfolio. MWR may not be the optimal

method to measure the performance of your account as returns can be biased by large top-ups or withdrawals.

The difference between TWR and MWR is that TWR does not factor in cash flow, while MWR factors in cash flow when

calculating the rate of return.

Note: You can reduce or increase your risk for your recommended portfolio. You will be alerted when you adjust

your risk appetite beyond the recommendation in your risk profile. The platform does not allow you to select

specific securities or unit trusts you wish to invest in.

Investing in market-traded instruments always involves the risk of principal loss, and past performance is not a

perfect indicator of expected future returns.

Always invest in accordance with your risk tolerance and financial objectives.

All screens shown and reference to any asset class are for illustration or information only and should not be

relied upon or construed as a recommendation of specific model portfolios.

Launch the Singtel Dash app and tap on the ‘Invest’ tile to start growing your wealth sustainably via UOBAM

Robo-Invest today. Get S$10 worth of credits* by simply opening an account by 30 June 2023, and an

additional S$20 worth of credits^ & 1,000 Dash reward points with a minimum top-up of S$500.

Singtel Dash app is available on the Google Play Store or Apple

App Store.

Please note that there are no charges for each top-up and withdrawal. However, the sale of assets will incur other

underlying fund-related fees such as trustee fees, valuation fees, US Securities and Exchange Commission (SEC)

fees (applies to sell trades for US-listed ETFs).

UOBAM Robo-Invest terms and conditions apply.

Important Notice & Disclaimers:

*UOBAM Robo-Invest S$10 worth of credits Sign-up Promotion is valid from 1 Jan 2023 to 30 June

2023 only. View full terms and conditions here.

^UOBAM Robo-Invest S$20 worth of credits Top-up Promotion is valid from 1 Jan 2023 to 30 June

2023, both dates inclusive, and open to all new and existing UOBAM Robo-Invest users. Limited to the first 500

UOBAM Robo-Invest users who meet the promotional criteria, excluding users who have qualified for the Lunar New

Year Promotion. View here for full promotional terms and conditions.

**Other US SEC fees, taxes and underlying fund-related fees apply. Visit dash.com.sg/uobam-roboinvest for details.

Fees are calculated and accrued daily and will be charged at the end of every calendar quarter. The quarter ends

on the last day of March, June, September and December.

This document is for your general information only. It does not constitute investment advice, recommendation or an

offer or solicitation to deal in Exchange Traded Funds (“ETFs”) or in units in any Unit Trusts (“Unit Trusts”,

ETFs and Unit Trusts shall together be referred to as “Fund(s)”) nor does it constitute any offer to take part in

any particular trading or investment strategy. This document was prepared without regard to the specific

objectives, financial situation or needs of any particular person who may receive it. The information is based on

certain assumptions, information and conditions available as at the date of this document and may be subject to

change at any time without notice. If any information herein becomes inaccurate or out of date, we are not obliged

to update it. No representation or promise as to the performance of the Fund or the return on your investment is

made.Past performance of any Fund or UOB Asset Management Ltd (“UOBAM”) and any past performance, prediction,

projection or forecast of the economic trends or securities market are not necessarily indicative of the future

or likely performance of the Fund or UOBAM. The value of any Fund and the income from them, if any, may fall as

well as rise, and may have high volatility due to the investment policies and/or portfolio management techniques

employed by the Fund. Investments in any Fund involve risks, including the possible loss of the principal

amount invested, and are not obligations of, deposits in, or guaranteed or insured by United Overseas Bank Limited

(“UOB”), UOBAM, or any of their subsidiaries, associates or affiliates (“UOB Group”) or distributors of the Fund.

Market conditions may limit the ability of the platform to trade and investments in non-Singapore markets may be

subject to exchange rate fluctuations. The Fund may use or invest in financial derivative instruments and you

should be aware of the risks associated with investments in financial derivative instruments which are described

in the respective Fund's prospectus. The UOB Group may have interests in the Funds and may also perform or seek to

perform brokering and other investment or securities-related services for the Fund. Investors should read the

Fund's prospectus, which is available and may be obtained from UOBAM or any of its appointed agents or

distributors, before investing. Notwithstanding the digital advisory services that will be provided to you through

UOBAM Robo-Invest,you may wish to seek advice from a financial adviser before making a commitment to invest

with UOBAM Robo-Invest, and in the event that you choose not to do so, you should consider carefully whether

investing through UOBAM Robo-Invest is suitable for you. Any reference to any specific country, financial

product or asset class is used for illustration or information purposes only and you should not rely on it for any

purpose. We will not be responsible for any loss or damage arising directly or indirectly in connection with, or

as a result of, any person acting on any information provided in this document. Services offered by UOBAM

Robo-Invest are subject to the UOBAM

Robo-Invest Terms and Conditions.

All screens shown and reference to any asset class are for illustration or information only and should not

be relied upon or construed as a recommendation of specific model portfolios. Projections shown are not indicative

of future or likely performance of any portfolio. Investments in any portfolio involve risks, including the

possible loss of the principal amount invested.

UOB Asset Management Ltd Co. Reg. No. 198600120Z